Sep 6 2011

The China CleanTech Index is to be launched at a conference in Xiamen, Fujian Province this morning by a leading Australian research company. The Index will, for the first time, provide a complete picture of the performance of Chinese cleantech companies that are listed on stock exchanges around the world.

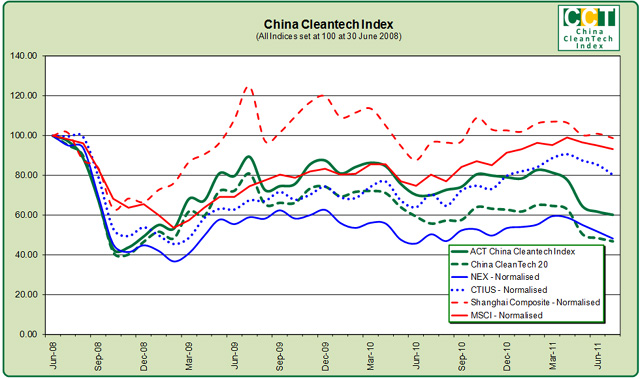

With over 110 companies falling under the coverage of the Index and with a combined market capitalisation of over 800 billion Renminbi (US$125 billion), the China CleanTech Index presents for the first time a picture of the Chinese cleantech industry’s growth in a single measure. The Index is weighted by market capitalisation and is benchmarked against Chinese and global indices measuring the performance of general stocks and also the cleantech sector.

Cleantech consists of products and services that have ‘economic and environmental benefits’. The sub-sectors of cleantech include renewable energy, water, waste and recycling, construction materials, energy efficiency, carbon trading and environmental services.

The China CleanTech Index is the initiative of Sino CleanTech, the Beijing-based operation of Australian CleanTech. Australian CleanTech is a research and advisory firm based in Australia that works for cleantech companies, investors and governments to deliver both an understanding of and growth in the sector. To launch the Index, Sino CleanTech has partnered with Top Capital, one of China’s leading finance magazines.

The Index will be launched at the 2011 The Ninth Capital Forum that is being held at Xiamen’s International Conference & Exhibition Center to an audience of China’s leading finance professionals.

Commenting from the launch, John O’Brien, Managing Director of Australian CleanTech, said, “We have been expanding our operations into China over the last few years because of the significant focus here on the sector from both the Chinese Governments and investors. In comparison to many western countries, there is a focus on building the industries of the future - and cleantech is central to a sustainable future..”

“The China CleanTech Index will enable global investors to get more visibility of the sector here and to understand both the depth and breadth of activity. There are other measures out there, but none of them capture the sector so completely by including all listed Chinese cleantech companies.”

In supporting the launch of the Index, Mr Li Zhiyong, the Managing Director of Top Capital, said “The cleantech sector in China is growing very strongly and this index will provide a measure of the activity across the entire industry for the first time.

We believe that this is an investment theme that is going to be of great interest to our readers. With the ongoing Chinese Government push to grow the cleantech sector, we believe that it is a sector that will continue to grow over the next few years.”

The performance of the Index since July 2008 is shown in the table below.

|

Percentage Change

(Measured on the 12 months to 30 June)

|

FY09

|

FY10

|

FY11

|

|

China CleanTech Index (CCTI)

|

-20.2%

|

-11.9%

|

-12.0%

|

|

China CleanTech 20 (CCT20)

|

-27.6%

|

-17.9%

|

-18.3%

|

|

Wilder Hill New Energy Global Innovation Index (NEX)

|

-44.5%

|

-17.6%

|

13.1%

|

|

China Shanghai Composite Index (SHCOMP)

|

8.2%

|

-19.0%

|

15.2%

|

|

MSCI World (MSCI)

|

-30.8%

|

8.0%

|

27.0%

|

Overall, the performance has generally been strong over the last three years in comparison to its benchmarks. There have been some outstanding sub-sector and individual company performances. With careful selections, it is possible to establish a very successful portfolio selection based on the index constituents.

Since March 2011 however, the cleantech sector in China has suffered driven by the loss of positive sentiment in the larger solar and wind stocks as global market conditions weaken. This may continue for a number of months yet but is forecast to recover towards the end of 2011 as some market rationalization occurs.

The China CleanTech Index also provides a number of sub-indices to enable greater transparency in the sector.

- To show the performance of the larger stock covered by the Index, the largest 20 Index constituents by market capitalisation during any quarter form the constituents of the China CleanTech 20.

- There are also eight sub-sector themed sub-indices, such as the China Solar Index and the China Wind Index. The best performers over the 12 months to 30 June 2011 were the China Environment Index with a 40% increase and the China Solar Index with a 31% increase. The worst performer was the China Hydro Index with a 36% decline.

Some other key statistics from the Index are:

- Of the 114 current Index constituents, 78 are listed in mainland China or Hong Kong with the remainder listed in Taiwan, North America, Europe and Australia.

- The sub-sector with the greatest number of companies is Solar with 28 followed by Wind, Water and Energy Efficiency, each with 15.

- The company size category with the largest number has companies with market capitalisations of between RMB 1 billion and RMB 5 billion.

“The China CleanTech Index is set to become the benchmark measure of cleantech industry performance in China,” O’Brien concluded.

For more information on the China CleanTech Index click here.