Nov 26 2013

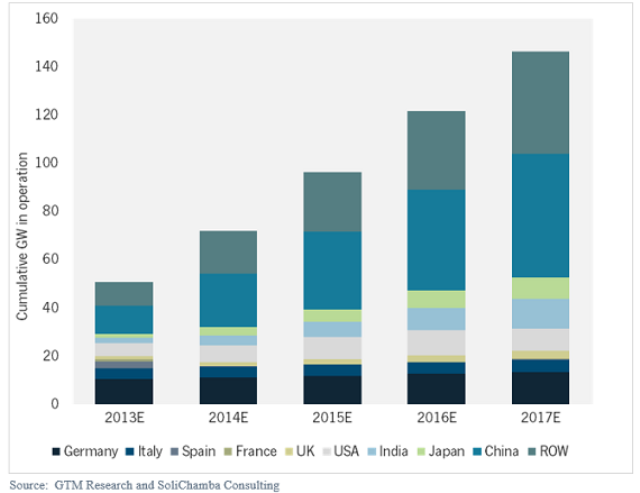

Operations and Maintenance (O &M), the set of technical activities that enable power plants to produce energy in compliance with investor expectations and applicable regulations, is a market that will triple its current size by 2017. According to GTM Research's new report, Megawatt-Scale PV Plant Operations & Maintenance: Services, Markets and Competitors 2013-2017, Europe currently leads the space but Asia-Pacific markets will drive installations over the next four years bringing the worldwide total to 146 gigawatts.

"In countries where new construction activity remains high or growing, little consideration is given to O &M as a standalone business," said report author Cedric Brehaut (Principal at SoliChamba Consulting). "The market tends to treat it as an extension of project development, EPC, or IPP activities." Conversely, in markets where new construction activity is low or decreasing, the industry quickly turns to O &M as a steady source of income, as observed in Italy or Germany. The U.S. is making this transition earlier than other markets, with the emergence of multiple independent O &M firms despite continued growth in new plant construction.

FIGURE: Cumulative Global Megawatt-Scale PV O &M Forecast, 2013-2017 (GW)

The competitive landscape of the PV O &M market is country specific, with different firms leading in each of the top solar markets. While the United States ranks sixth in terms of current megawatt-scale installations, the top three providers (First Solar, SunEdison, and SunPower) all primarily service the United States. Beyond the fast growth of the utility-scale PV industry in North America, the O &M market is more concentrated in the U.S., while it appears highly fragmented in European markets such as Germany and Italy.

Price and service tend to also vary across geographies, with variations as high as 100 percent between low-price markets like the U.S. and high-price markets like Italy. "Interestingly, higher prices do not necessarily mean higher service levels" commented Brehaut. "Instead, they are mostly driven by the local market value of solar energy and the intensity of competition between O &M providers."

The 220-page report contains O &M service levels and price ranges for six key PV countries, a global competitive landscape analysis, current market size and forecast to 2017 for nine countries, and analysis of O &M activities, constraints and strategies. Additionally, the report profiles 61 vendors across continents whose aggregated O &M fleet currently surpasses 16 gigawatts. For more information, visit http://www.greentechmedia.com/research/report/MW-scale-PV-plant-operations-and-maintenance-2013-2017