Apr 23 2014

A new report from the Geothermal Energy Association (GEA), released today at the organization’s International Geothermal Showcase in Washington, D.C., reveals the international power market is booming, with a sustained growth rate of 4% to 5%.

The “2014 Annual U.S. & Global Geothermal Power Production Report” finds almost 700 projects currently under development in 76 countries. Threats caused by climate change and the need for a renewable energy source that can satisfy both firm and flexible grid needs are among the key factors driving the international community to invest in geothermal power.

International geothermal market growth was up, while stateside growth held steady; 85 MW of the total global 530 MW of new geothermal capacity in 2013 was in the U.S., according to the new GEA report. U.S. growth was flat because of policy barriers, gridlock at the federal level, low natural gas prices and inadequate transmission infrastructure.

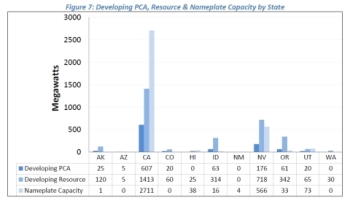

“While there was a modest downturn in capacity additions, the Industry Update also underscores the tremendous untapped potential for geothermal energy,” said GEA Executive Director Karl Gawell. According to the report, the geothermal industry was working on 977MW of new capacity (Planned Capacity Additions or PCA’s) at sites that hold over 3,092MW of power potential in eight western states, the GEA report indicates (see Figure 7).

U.S. additions in Utah, Nevada, California, and New Mexico kept the industry on the map domestically in 2013, and future growth looks promising. “The geothermal resource base is still largely untapped,” noted Ben Matek, GEA’s Industry Analyst. “With new initiatives in Nevada, California and Oregon moving to recognize the values of geothermal power, we are optimistic that state policies could spark another period of growth in geothermal power over the next decade,” he added.

In 2013, 25 pieces of legislation in 13 U.S. states were enacted specifically to address geothermal power and heating systems, creating a foundation for the environment needed to foster geothermal growth in these states. Past evidence shows successful policy initiatives have translated into growth; in Nevada, for example, which leads the way as one of the most business-friendly environments, the number of developing projects (45) more than doubles that of California (25).

The Salton Sea Resource Area is a new initiative of California that could be a significant source of growth for the U.S. geothermal power industry if several policy barriers are overcome in the near term. The Imperial Irrigation District has pledged to build up to 1,700 MW of geothermal power by the early 2030’s at the Salton Sea. If successful, this initiative could increase the nameplate capacity of the U.S. by 50% over the next 20 years.

Elsewhere in the U.S., the Public Utility Commissions in Nevada and Oregon recently created potentially beneficial opportunities for geothermal power, while the Washington State Assembly clarified confusing legislation. New Mexico debuted its first geothermal power plant in 2013, with work by Cyrq Energy, and the state showed legislative support for future projects when it passed H.B 85. The legislation matches federal royalty rates and requires geothermal resources be managed as renewable resources. In Alaska, the City of Akutan is supporting a promising project, which may lead to the state’s first utility-scale geothermal power plant.

Some myths have surfaced that geothermal power is reaching its potential capacity in states like California and Nevada. These states still have a significant amount of known untapped potential that could be used domestically or exported to surrounding states. Overall, GEA estimates about 50% of California’s known resources, 60% of Nevada’s, and 60% of Utah’s are still untapped.

Globally, significant geothermal development growth is expected over the next few years. In East Africa, Kenya and Ethiopia are building power plants greater than 100 MW. For comparison the average size of a geothermal power plant in the U.S. is about 25 MW. South American nations such as Chile, Argentina, Colombia and Honduras have significant potential, but are in the early stages of identifying their resources. The GEA estimates that Chile is actively developing 50 projects and prospects.

These are only a sampling of the vast increases globally; looking at the numbers in Figure 2 of the new GEA report, there could be a time in the near future when the United States is no longer the world leader in geothermal energy production. For instance, the U.S. has about 1,000 MW in the pipeline and 3,400 MW nameplate capacity for a total of 4,400 MW. Meanwhile, Indonesia has 4,400 MW of planned capacity additions announced in the pipeline alone.

In terms of established nameplate capacity, the U.S. (with a total in 2013 of 3,442 MW) still outpaces the Philippines (1,904 MW in 2013) and Indonesia (1,333 MW), the world’s second and third ranked geothermal energy producers.

Representatives from 34 countries will come together at the GEA Geothermal Showcase today in Washington DC. Showcase participants will represent more than half of all geothermal projects worldwide. Together, these projects could mean over 10,000 MW of new geothermal power and would represent around $45 billion in new investment.

At the Showcase, GEA will host a media availability with geothermal industry leaders at 12:15pm ET to discuss the release of GEA’s new, consolidated annual update on the U.S. and international geothermal industries, as well as geothermal trends and governmental policies in the U.S. and around the world. There will also be a dial-in option for journalists who can’t attend in person. For more information, or to request press credentials or dial-up instructions, please contact Shawna McGregor, The Rosen Group, 917 971 7852 or [email protected].