Aug 11 2015

Wind energy pricing is at an all-time low, according to a new report released by the U.S. Department of Energy and prepared by Lawrence Berkeley National Laboratory (Berkeley Lab). The prices offered by wind projects to utility purchasers averaged under 2.5¢/kWh for projects negotiating contracts in 2014, spurring demand for wind energy.

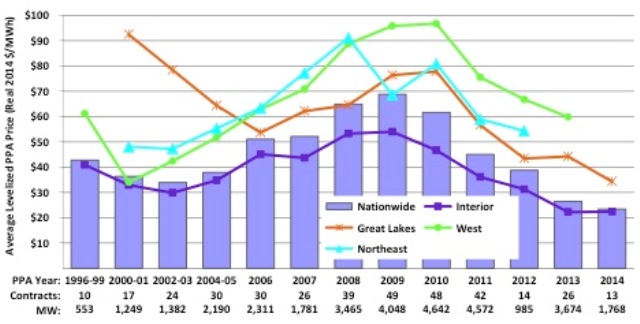

Generation-weighted average levelized wind PPA prices by PPA execution date and region.

Generation-weighted average levelized wind PPA prices by PPA execution date and region.

“Wind energy prices—particularly in the central United States—have hit new lows, with utilities selecting wind as the low cost option,” Berkeley Lab Senior Scientist Ryan Wiser said. “Moreover, enabled by technology advancements, wind projects are economically viable in a growing number of locations throughout the U.S.”

Key findings from the U.S. Department of Energy’s latest “Wind Technologies Market Report” include:

- Wind is a credible source of new electricity generation in the United States. Wind power capacity additions in the United States rebounded in 2014, with $8.3 billion invested in 4.9 gigawatts (GW) of new capacity additions. Wind power has comprised 33% of all new U.S. electric capacity additions since 2007. Wind power currently meets almost 5% of the nation’s electricity demand, and represents more than 12% of total electricity generation in nine states, and more than 20% in three states.

- Turbine scaling is enhancing wind project performance. Since 1998-99, the average nameplate capacity of wind turbines installed in the United States has increased by 172% (to 1.9 MW in 2014), the average turbine hub height has increased by 48% (to 83 meters), and the average rotor diameter has increased by 108% (to 99 meters). This substantial scaling has enabled wind project developers to economically build projects in lower wind-speed sites, and is driving capacity factors higher for projects located in various wind resource regimes. Moreover, turbines originally designed for lower wind speeds are now regularly deployed in higher wind speed sites, further boosting project performance.

- Low wind turbine pricing continues to push down installed project costs. Wind turbine prices have fallen 20% to 40% from their highs back in 2008, and these declines are pushing project-level costs down. Wind projects built in 2014 had an average installed cost of $1,710/kW, down almost $600/kW from the peak in 2009 and 2010.

- Wind energy prices have reached all-time lows, improving the economic competitiveness of wind. Lower wind turbine prices and installed project costs, along with improvements in expected capacity factors, are enabling aggressive wind power pricing. After topping out at nearly 7¢/kWh in 2009, the average levelized long-term price from wind power sales agreements signed in 2014 fell to just 2.35¢/kWh—the lowest-ever average price in the U.S. market, though admittedly focused on a sample of projects that largely hail from the lowest-priced central region of the country. The continued decline in average wind prices, along with a bit of a rebound in wholesale power prices, put wind below the bottom of the range of nationwide wholesale power prices in 2014. Wind energy contracts executed in 2014 also compare very favorably to a range of projections of the fuel costs of gas-fired generation extending out through 2040. These low prices have spurred demand for wind energy, both from traditional electric utilities and also, increasingly, from commercial customers.

- The manufacturing supply chain continued to adjust to swings in domestic demand for wind equipment. Wind sector employment increased from 50,500 in 2013 to 73,000 in 2014. Moreover, the profitability of turbine suppliers has generally rebounded over the last two years, after a number of years in decline. For wind projects recently installed in the U.S., domestically made content is highest for nacelle assembly (>90%), towers (70-80%), and blades and hubs (45-65%), but is much lower (<20%) for most components internal to the nacelle. Exports of wind-powered generating sets from the United States rose from $16 million in 2007 to $488 million in 2014; tower exports equaled $116 million in 2014. Despite the significant growth in the domestic supply chain over the last decade, however, far more domestic manufacturing facilities closed in 2014 than opened. With an uncertain domestic market after 2016, some manufacturers have been hesitant to commit additional long-term resources to the U.S. market.

Berkeley Lab’s contributions to this report were funded by the U.S. Department of Energy’s Office of Energy Efficiency and Renewable Energy.