Nov 27 2020

European international oil companies (IOCs) are leading the way in terms of progressing strategies for renewable power growth, ahead of US players that have not, so far, made the same switch.

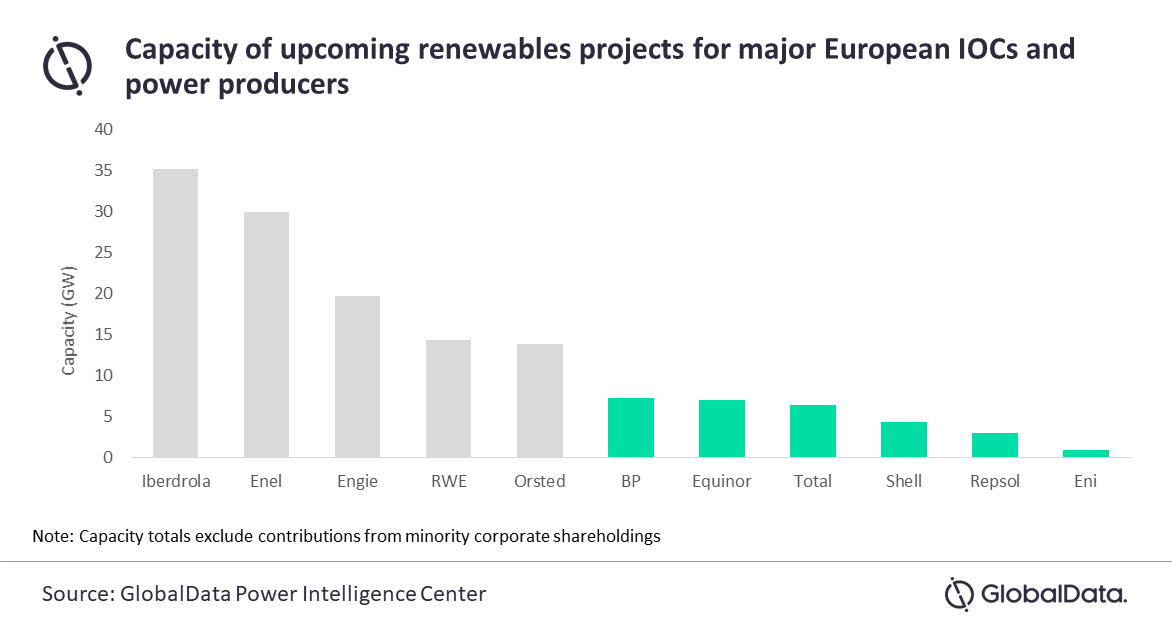

The top six European firms have over 28 GW of renewables capacity in the pipeline, with BP, Total and Equinor making up over 70% of this. However, the scale of these companies’ developments still lags behind major power sector incumbents, says GlobalData, a leading data and analytics company.

Will Scargill, Managing Oil and Gas Analyst at GlobalData, commented: ‘‘IOCs’ current development portfolios are still significantly smaller in scale than those of incumbents in the power sector. However, long-term targets suggest an ambition to make up this ground - with BP’s 2030 target of 50 GW significantly exceeding Orsted’s target of 30 GW.

“The rapid build-out of European IOCs’ renewable portfolios is encouraging as they look to position themselves for the energy transition. However, lofty ambitions do come with significant risk - particularly as they will still look to their oil and gas businesses to be the major cash generators through the medium term. A weak oil and gas market could leave companies unable to fully fund their renewables growth plans, leaving them with a diminished position in the overall energy market.’’

Oil and gas companies looking to transition into the renewables are making significant moves in the mergers and acquisitions (M&A) space to support their growth ambitions. Recent months have seen Total announce a flurry of deals in the wind and solar sectors, while BP announced its entry into offshore wind with a $1.1bn deal to partner with Equinor in US developments.

Scargill continued: ‘‘Solar PV and offshore wind developments account for most of IOCs’ renewables development pipelines. Solar has the benefit of low costs and a short investment cycle, supporting rapid capacity build-out, while offshore wind is expected to see the fastest growth within renewables over the next decade and has the benefit of exploiting oil companies’ experience in offshore development.’’