Creating a circular economy is an essential sustainability target for stakeholders across the plastic value chain. Conventional mechanical recycling methods are necessary, but given the inferior product properties, this downcycling will only go so far; this is where chemical recycling and dissolution processes enter the picture. Chemical recycling attracts both notable critics and strong supporters, but the commercial momentum is building. IDTechEx has launched a new market report providing a technical assessment and independent market outlook on the topic; overall, it is forecast that pyrolysis and depolymerization plants will recycle over 20 million tonnes/year of plastic waste by 2033.

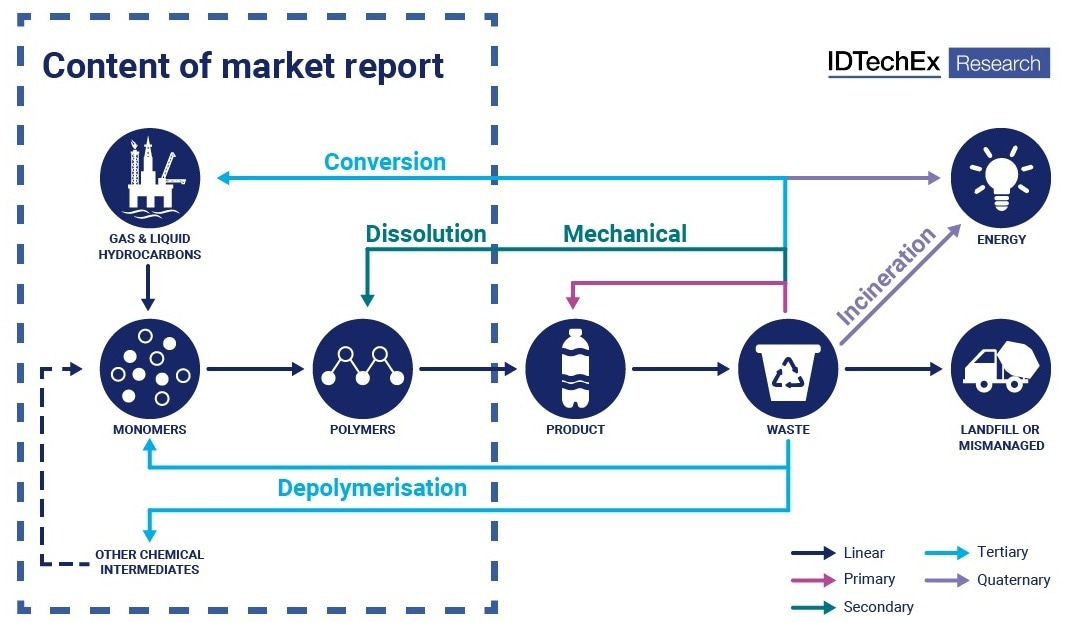

Market report content. Image Credit: IDTechEx - “Chemical Recycling and Dissolution of Plastics 2023-2033”

Market report content. Image Credit: IDTechEx - “Chemical Recycling and Dissolution of Plastics 2023-2033”

In their brand new market report, “Chemical Recycling and Dissolution of Plastics 2023-2033”, IDTechEx provides unbiased 10-year market forecasts, industry analysis, and critical technical assessment on pyrolysis, depolymerization, gasification, and dissolution processes both in-use today and being proposed for the near future to enable a circular economy.

The existing ISO definition (ISO 472: 2013: 2.1690) states: feedstock (= chemical) recycling: recycling of plastic waste: conversion to monomer or production of new raw materials by changing the chemical structure of plastic waste through cracking, gasification or depolymerization, excluding energy recovery and incineration.

Headlines on the investments, planned expansions, and real-world product launches are all accelerating in their frequency and scale. The largest petrochemical companies, consumer goods companies and other key stakeholders in the value chain are responding with both internal developments and external engagements; early-stage technology companies are announcing funding, strategic partnerships, joint development agreements, and offtake agreements from critical players in the supply chain.

Overall, IDTechEx forecast that pyrolysis and depolymerization plants will recycle over 20 million tonnes/year of plastic waste by 2033. This is a significant number but will require a major investment and continuous engagement from stakeholders across the value chain. Despite this large projection, the global impact should not be overlooked, there is an ever-increasing production of fossil-based plastic, with an annual production of 429m tonnes (OECD, 2019), immediate challenges with waste management; chemical recycling has a role to play in closing the loop, but it is just one piece of the complex global puzzle.

Chemical recycling also has notable critics. They point out the flaws in the claimed environmental benefits, such as the assumptions behind life cycle assessments, including the comparison that waste would have otherwise been incinerated, and question the economic viability. The economics are challenging and not only influenced by the company’s process (such as yield, feedstock requirements by plastic-type & form, and efficiency at scale) but also the associated infrastructure, policy, and macroeconomic trends; the “green premium” for the products is a key factor, the further prices can be decoupled from that of oil the greater the long-term success of these projects. The IDTechEx report aims to provide a balanced view of both those endorsing and criticizing the technology, many criticisms are valid, and advocacy groups, alongside failed projects, will inhibit the growth, but IDTechEx do not believe they will prevent the trajectory for this market.

IDTechEx has a longstanding history in providing an independent technical and market assessment on sustainable plastics. This market report includes:

- 10-year market forecasts for pyrolysis, depolymerization, gasification and dissolution; appropriate forecasts segmented by different polymer types

- Overview of the environmental impact and economic viability for each technology

- Assessment of key manufacturers, including their partnerships, funding & capacity expansions.

- Success stories, including product launches and failures. End-user activity from single-use plastics in FMCG packaging to various textiles, automotive parts, electronic equipment, and beyond

- Overview of solutions and developments for key polymers, including PP, PET, PS, PE, PU, PMMA, PA, PC, and PLA

- Analysis of the key market drivers: governments, companies (stakeholders across the value chain including product manufacturers, brands & retailers), NGOs, and public

- Global view of the status of the plastic recycling market, including recycling rates, chain of custody, location, design for recyclability, and more

- Technology appraisal of chemical recycling and dissolution processes that enable a circular economy. This includes strengths, limitations, challenges, criticisms, and outlook

- Comprehensive list of technology providers for each process

- Complete list of operational plants and planned projects worldwide with corresponding chemical recycling market shares

- Analysis of latest R&D and technology trends with a commercial impact. This includes microwave and enzymatic processes for depolymerization, hydrothermal approaches as a competition to pyrolysis, new polymer developments and more

- Interview-based player profiles

To find out more about the brand new IDTechEx report “Chemical Recycling and Dissolution of Plastics 2023-2033”, including downloadable sample pages, please visit www.IDTechEx.com/ChemicalRecycling.